COVID-19 PF Advance Fund: Know More

COVID-19 has had a significant economic influence over the world. The first two waves of the epidemic in India left several families in financial distress. Things have become more challenging again as the number of Omicron cases has increased. In 2020, the government approved a tax-free, non-refundable COVID-19 advance from the Employees’ Provident Fund (EPF). This was repeated in 2021, with people being able to receive a second COVID-19 EPF advance.

The Pradhan Mantri Garib Kalyan Yojana has a provision for this extraordinary withdrawal in March 2020. (PMGKY). The Employees’ Provident Fund Organisation (EPFO) had settled over 76.31 lakh COVID-19 advance claims as of May 31, 2021, disbursing a total of Rs 18,698.15 crore.

The EPF is especially beneficial if you are facing large medical bills or the loss of a job. If the pandemic has already forced you to borrow above your means and pile loans on top of each other, the EPF can help you deal with unexpected financial hardships. In uncertain times, using the EPF is always a better alternative than taking on more debt. EPF can be applied totally online and will be credited to your bank account, allowing you to receive funds even if you are operating from a remote place or are quarantined.

The Government of India introduced the Covid-19 PF Advance option, which allows individuals to take a set amount from their Employees’ Provident Fund (EPF) account to help with their financial position during the present coronavirus pandemic. The request form is available on the official EPFO website, as well as the UMANG app and website.

If You Want to Apply for Pf Advance, We’ve Put Up Step-By-Step Guidance as Well as a Few Points to Keep in Mind Before You Start.

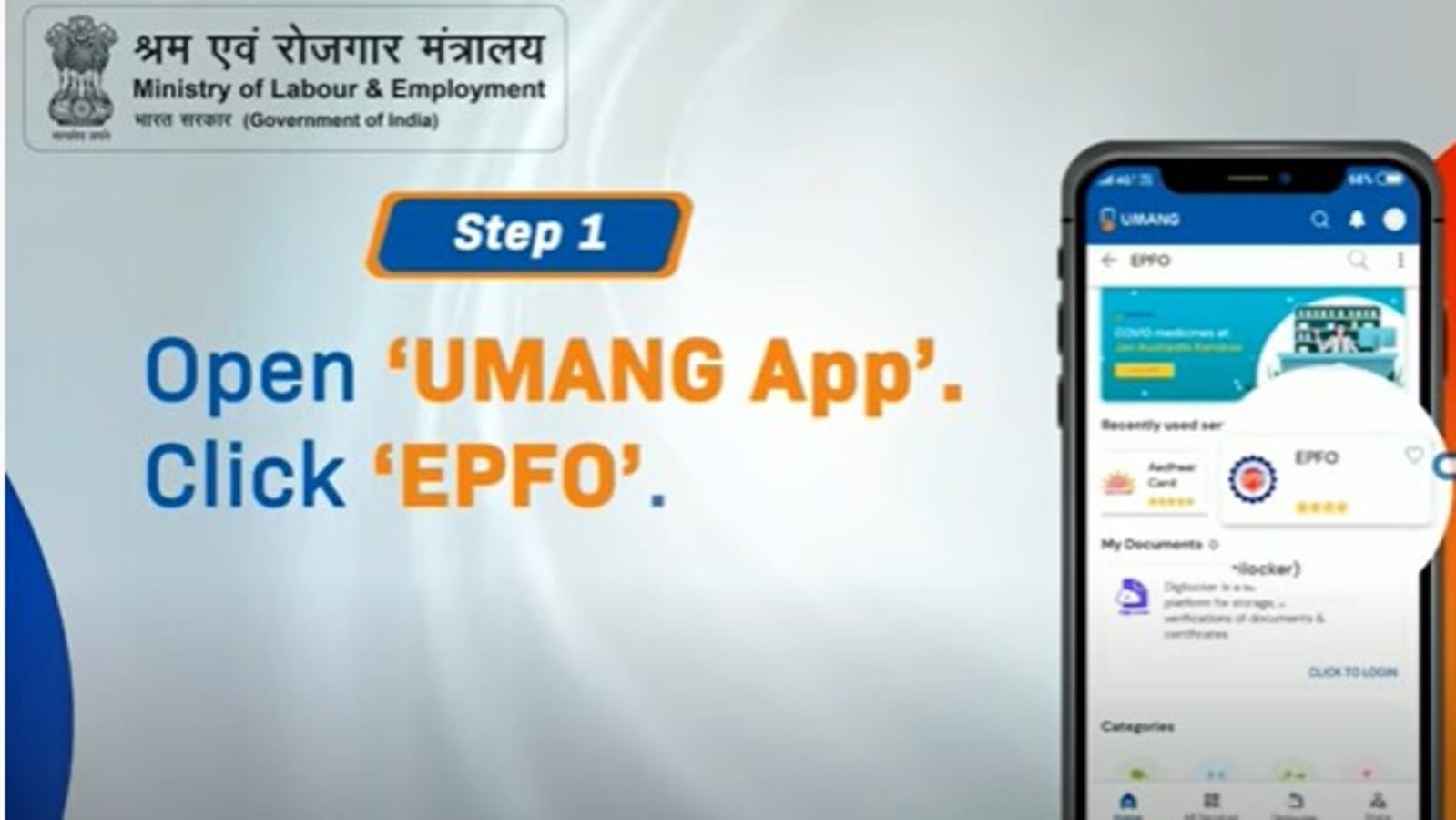

1. Get the UMANG app and install it. Continue to the second step if you already have the UMANG app installed.

2. On your smartphone, open the UMANG app and select EPFO. If you don’t see the EPFO option, type EPFO into the search field.

3. Select ‘Request for Advance (Covid-19)’ from the drop-down menu.

4. Tap ‘Get OTP’ after entering your UAN number. This OTP will be sent to the EPFO-registered phone number.

5. To login, enter the OTP you received and press the “Submit” button.

6. Once logged in, select ‘Member ID’ from the drop-down option and enter your bank account number.

7. Next, press the ‘Proceed for Claim’ button.

8. On the following page, type in your address and click Next.

9. Now, from the drop-down option, choose Form 31 and fill in the ‘Amount of Advance Required’ field.

10. Upload a photo of a check that clearly shows the bank name, IFSC code, and account number. Please keep in mind that the upload file must be less than 100kb in size.

11. Select the checkbox next to the declaration and hit Submit OTP.

12. Tap the ‘Submit’ button after obtaining the Aadhaar OTP. The application for Covid-19 Advance has been filed.

Consider the Following Points:

Individuals can use PF Advance to get a non-refundable withdrawal for up to three months. The amount is limited to the employee’s basic pay or up to 75% of the total debt, whichever is lower. Individuals must have their UAN confirmed using Aadhaar in order to withdraw or submit an application. A phone number should also be associated with the UAN.